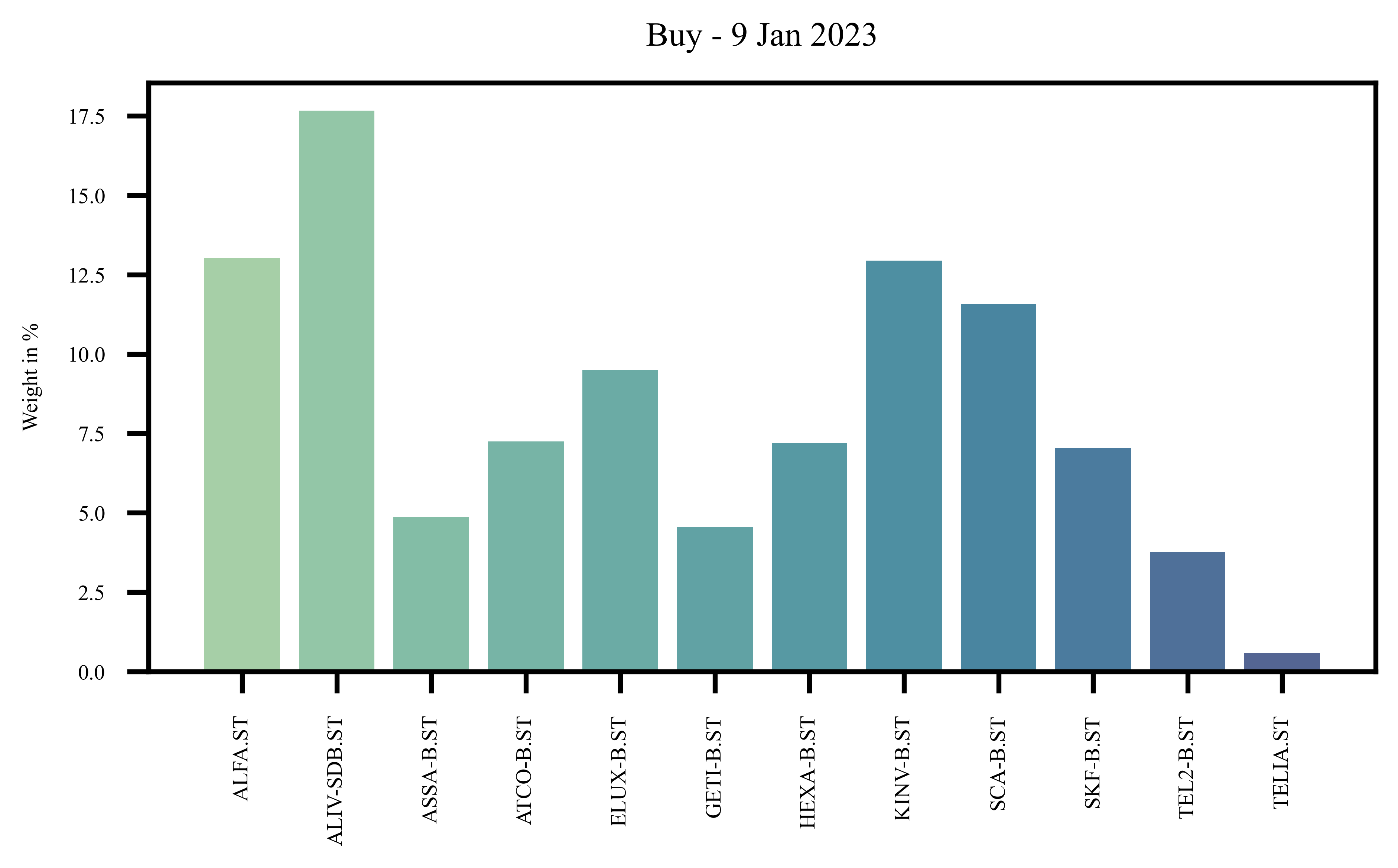

Do I really want more HEXA? And TELIA?

A brave new month and brave new cash to burn (or invest). Illustrated below, are the ParaTopia investments as of August. Corresponding to the following units bought today: ATCO-A.ST = 4, ERIC-B.ST = 1, HEXA-B.ST = 8, HM-B.ST = 2, INVE-B.ST = 1, NDA-SE.ST = 2, SAND.ST = 1, SEB-A.ST = 1, SHB-A.ST = 1, SWED-A.ST = 1, TELIA.ST = 28, and VOLV-B.ST = 3. Now I wonder, given the last events as mentioned in AZN good. HEXA very bad. , do I really want to buy more HEXA? Could be that they are a bit underpriced but 18% of the total portfolio this month is still not nothing. Another matter is the 14% and 28 units of TELIA that my investment strategy supposedly wants me to buy. TELIA who is about -18% down YTD, -42% LTM, and -40% since inception in 2005. If nothing else, I hope it’s a good diversifier.